The Canadian housing market has been a rollercoaster ride in recent months, and the latest twist in the tale is the impact of rising interest rates on reverse mortgages.

HomeEquity Bank (HEB), the largest provider of reverse mortgages in Canada through its CHIP reverse mortgage product, has reported a significant slowdown in the growth of its reverse mortgage portfolio, according to recent regulatory filings with the Office of the Superintendent of Financial Institutions (OSFI).

Read More: The Ultimate Guide to CHIP Reverse Mortgages in Canada

A Closer Look at the Numbers

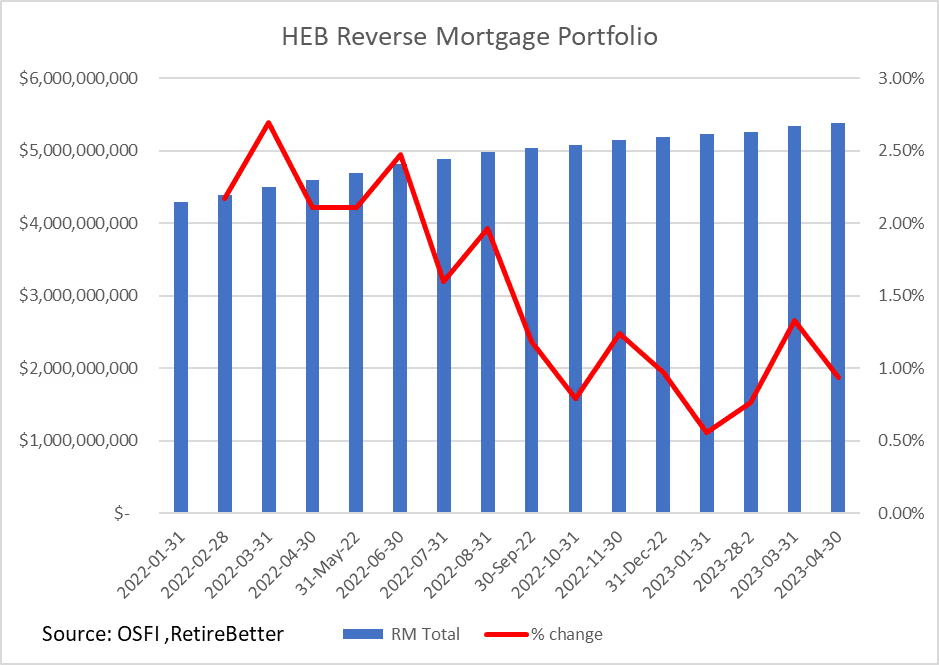

Between January 31, 2022, and December 31, 2022, HEB's total reverse mortgage portfolio grew from $4.2 billion to $5.2 billion. However, the rate of monthly growth has been on a downward trend, dropping from a high of 2.69% in early 2022 to 0.97% in December 2022.

This trend has continued into 2023, with three of the first four months showing less than 1% monthly growth.

Rising Mortgage Interest Rates: The Impact on Reverse Mortgages

Ajay Singh, Managing Director of RetireBetter, attributes this slowdown to Canada's rising interest rate environment. "Higher interest rates have had a significant negative impact on home prices and the overall cost of borrowing," Singh said. HEB's filings reveal that the bank's borrowing costs as a percentage of their mortgage income have risen from 40% in early 2022 to 51% as of Q1 2023.

This has led to increased reverse mortgage rates and reduced loan amounts to prevent loan balances from growing too quickly.

Rising Interest Rates: The Pressure on Homeowners

The repercussions of these changes are being felt by homeowners over the age of 55, many of whom were considering reverse mortgages to deal with the increase in overall costs of living. With home values dropping or remaining flat across the country, their home equity amounts are decreasing, and the cost of reverse mortgages is increasing.

"Many homeowners cannot qualify for a large enough reverse mortgage and are looking for options other than reverse mortgages," Singh added.

The Reverse Mortgage Market: Looking Ahead

As the interest rate environment continues to evolve, it remains to be seen how this will impact the reverse mortgage market and the financial strategies of homeowners over 55. It's clear that the landscape is shifting, and homeowners need to be aware of these changes as they plan for their financial future.

In these uncertain times, seeking professional advice and exploring all available options is more important than ever. Whether it's downsizing, renting, or considering a traditional mortgage or home equity line of credit, homeowners must make informed decisions that best suit their individual circumstances and retirement goals.

Read More: The Pros and Cons of Downsizing for Seniors

Stay tuned for more updates on the Canadian housing market and the impact of rising interest rates on reverse mortgages.