Are you a senior in Canada wondering how a reverse mortgage could help you unlock the value of your home? If you are, we suspect you have tried an online reverse mortgage calculator.

We understand that, for some people, the thought of diving into the world of mortgages and calculations can be overwhelming. We're here to simplify the process and help you make informed decisions without feeling lost in a sea of digits. So, if you’re ready to unlock the secrets of the best reverse mortgage calculators in Canada for 2023, you’re in the right place.

Our reverse mortgage experts have tested and reviewed these calculators to ensure accuracy, reliability, and user-friendliness. We’ve done the legwork, scrutinized the options, and handpicked the cream of the crop just for you.

In this comprehensive review, we'll guide you through the top reverse mortgage calculators available, providing you with the tools to assess your options confidently. Now, let's dive into the world of reverse mortgage calculators and discover the best tools to help you unlock the potential of your home equity.

Our Methodology: We googled “best reverse mortgage calculator Canada” and checked out the results. We ignored any sponsored ads and only looked at Google’s organic results.

Key Takeaways:

- Google can provide misleading information for Canadian homeowners searching “best reverse mortgage calculator Canada” so users should be sure they are on Canadian websites.

- The CHIP reverse mortgage calculator tops our review and the RetireBetter reverse mortgage calculator is a strong second option for homeowners to consider.

- General financial service websites are included in Google’s top results due to the high number of monthly visitors, not because of their high quality reverse mortgage resources

Search Result #1: Wowa Reverse Mortgage Calculator

Who are they?

Wowa is a general financial information website and has info on credit cards, bank accounts, GICs and mortgages. It is not a dedicated site for reverse mortgage information.

Is the Calculator Easy to Find?

Wowa does not make their reverse mortgage calculator easy to find from their main pages. Unless you save your google search and use it to go to the calculator page, you will quickly get lost looking for the Wowa reverse mortgage calculator. Interestingly, Wowa does not include their calculator with the rest of their online calculators...so you cannot find it that way either.

FYI, you can do a site search to find their calculator if you get lost looking for it. Wowa loses a lot of points from us simply by making their calculator so difficult to access for future reference. It just seems like the design was an afterthought.

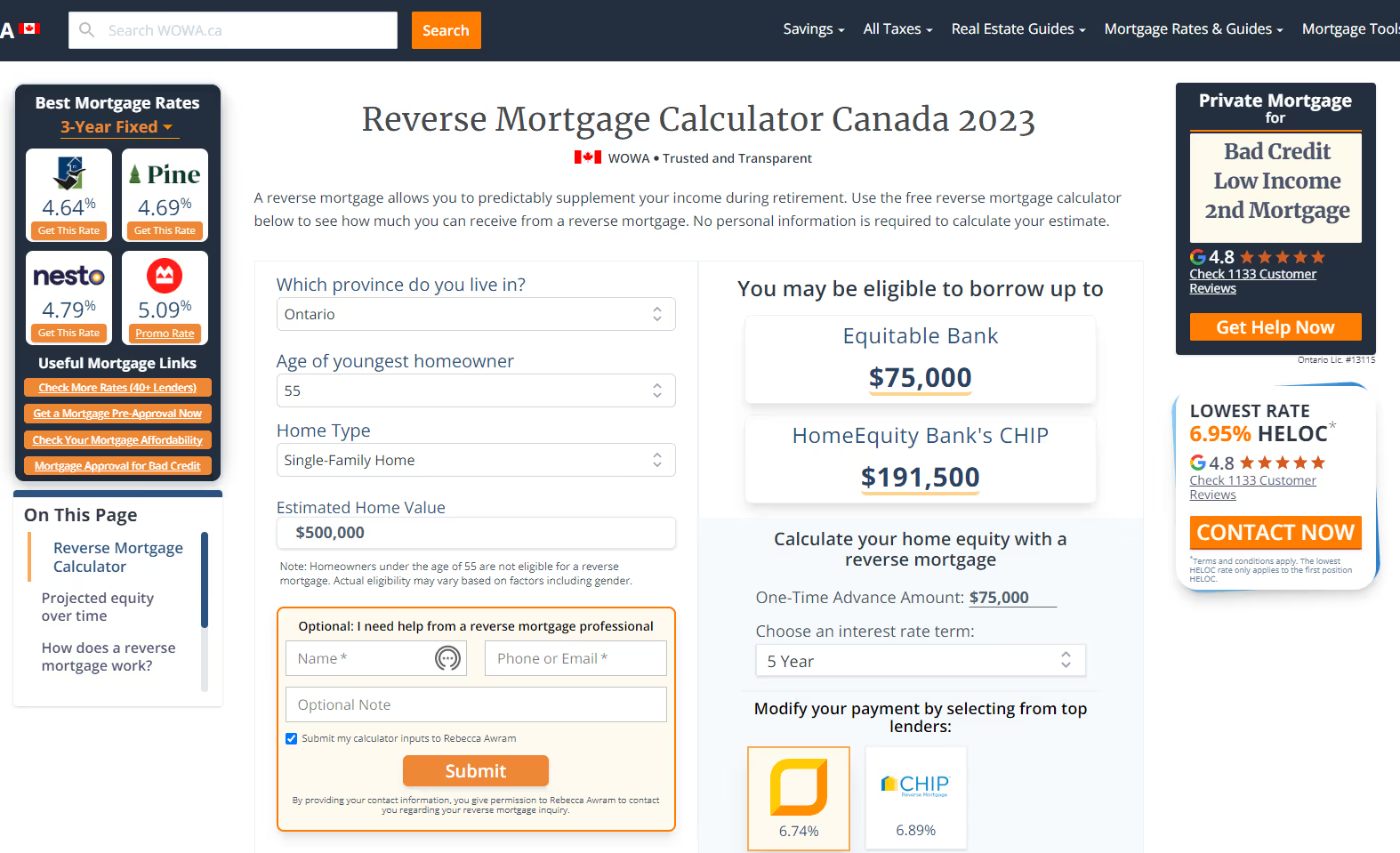

What Information Does the Calculator Require?

The requested information consists of four simple fields: province, age of the youngest homeowner, home type, and home value.

These fields are presented as drop-down options, making it easy and convenient for users to provide the necessary details. The process is designed to be user-friendly, requiring minimal effort to complete. Importantly, no personal information is requested, ensuring privacy and data security.

By selecting the province from the drop-down menu, users can specify their location, which can have implications on the loan limits of the loan. Next, users are asked to enter the age of the youngest homeowner, as age plays a crucial role in determining the maximum loan amount.

The home type field allows users to specify the type of property they own, such as a detached house, townhouse, or condominium. This information helps shape the assessment of the property's value and potential eligibility for a reverse mortgage.

Lastly, users are prompted to input the estimated value of their home, which is a key factor in determining the loan-to-value ratio and the potential amount that can be borrowed.

What Information Does the Calculator Provide?

Upon providing the requested information, the calculator generates possible loan amounts based on the selected province. Depending on the province, you may receive loan amount estimates from HEB and EQ, or solely from HEB. This feature allows users to get an idea of the potential borrowing capacity available to them through a reverse mortgage.

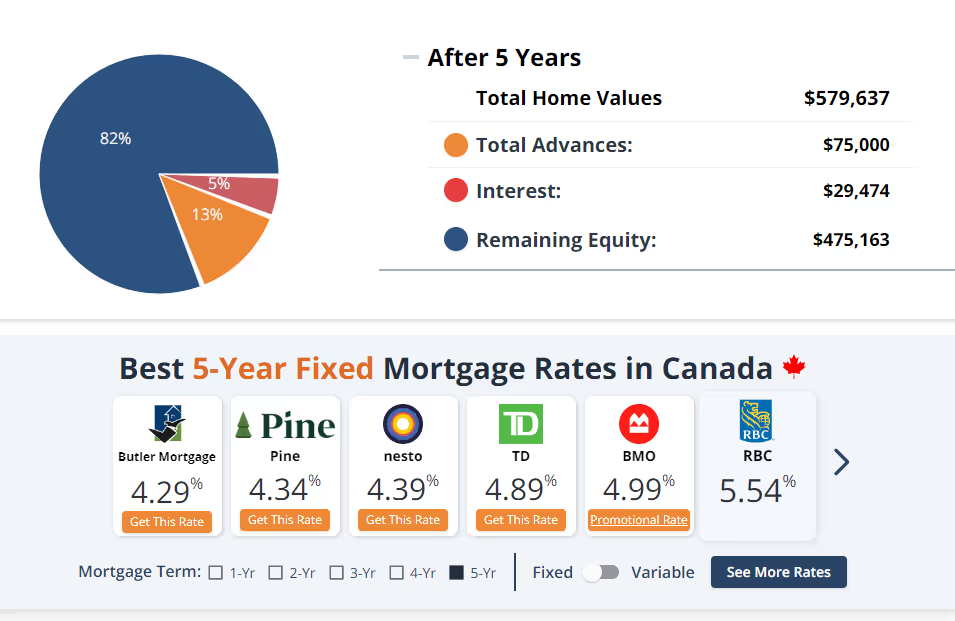

In addition to the loan amount estimates, the calculator also presents interactive charts that illustrate how the value of your home and loan balance may change over a 20-year period. These visual representations can provide valuable insights into the long-term financial implications of a reverse mortgage, allowing you to assess the potential impact on your home equity and loan balance over time.

For those who prefer a more detailed breakdown of the loan balance and payment schedule, the calculator offers the option to download an amortization schedule:

This amortization schedule provides a comprehensive overview of the loan repayment process, including specific details about interest rates, monthly payments, and how the loan balance changes over time. Users cannot adjust the calculations in the amortization table. Our biggest issue with the information provided by Wowa is…just the sheer amount of information provided on the screen.

Traditional mortgage rates are presented alongside reverse mortgage rates, which may be confusing to users:

Information is generally not presented in a user-friendly manner and we suspect the calculator would be information overload for almost every typical person considering a reverse mortgage.

Was the Calculator Accurate?

During our review, we noticed the Wowa calculator was not accurately reflecting the rates being offered for the CHIP reverse mortgage by HomeEquity Bank. Also, the Wowa calculator seemed to present a mix of rates from the CHIP Reverse Mortgage and CHIP Max products without providing a clear explanation for the distinction or the reason for doing so.

Furthermore, the rates presented by the calculator varied significantly, with differences of almost 25%. It appeared that the calculator selected a loan amount from the CHIP Max product and displayed pricing for the regular CHIP product, leading to a discrepancy in the rates presented.

On the other hand, the Equitable Bank reverse mortgage rates listed were closer to accuracy, with a difference of not more than ten basis points compared to the actual EQ rates at the time of review.

We think any site that is going to list rates has to take on the responsibility of displaying accurate information. Having said that, we would also recommend homeowners speak to a reverse mortgage expert to obtain the most accurate and current rates for their specific situation.

Our Verdict

Here is our verdict on the Wowa reverse mortgage calculator:

Pros:

- Works without requesting contact information.

- Easy to use and displays loan amounts and interest rates from 2 major lenders.

- Gives lots of information and charts to review.

Cons:

- Information is not accurate – perhaps it is better not to display information than to display wrong and misleading information.

- Information is not presented in a user-friendly manner.

- The Wowa calculator makes equity projections over 20 years but does not disclose calculations used or allow users to modify the calculations.

Overall, the Wowa reverse mortgage calculator is trying to do it all by including rates, charts, amortization and educational material. But it misses the mark as information is outdated, misleading or just wrong. It gets to the top of Google’s search results based on the overall Wowa website popularity but is not a good source for anyone considering a reverse mortgage.

Our Grade

We give the Wowa reverse mortgage calculator a B grade.

Google Search Result #2: CompareWise Reverse Mortgage Calculator

Who are they?

Comparewise is another general financial information website and has info on credit cards, bank accounts, GICs and mortgages. Comparwise is not a dedicated site for reverse mortgage information.

Is the Calculator Easy to Find?

Since Comparewise takes a kitchen-sink approach to financial information, a visitor either finds the reverse mortgage link from Google or is left digging around on the site. We found the Comparwise reverse mortgage calculator hard to locate and access from the Comparewise main page. The site does not offer a site search feature.

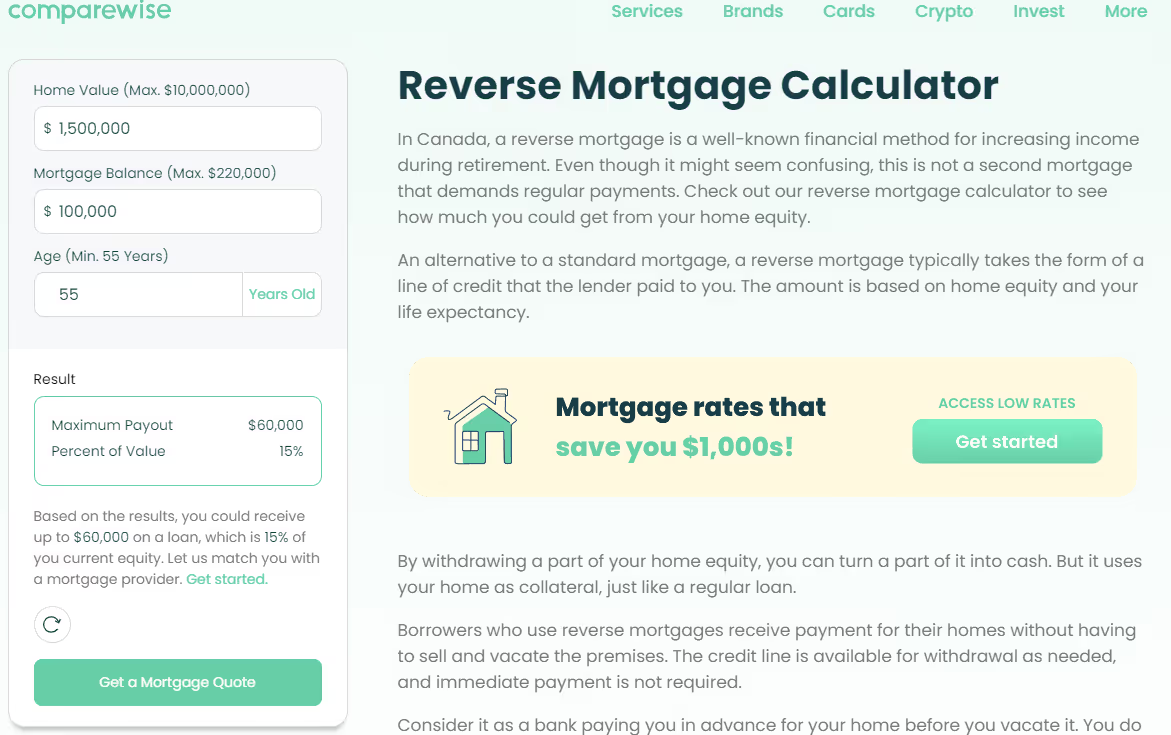

What Information Does the Calculator Require?

We found the Comparewise calculator to be straightforward with three easy-to-complete drop-down fields. The required information included age, home value, and mortgage balance. It is worth noting that no personal information was requested, which prioritizes user privacy and security.

What Information Did the Calculator Provide?

Upon using the website's information request feature, it provided a useful feature that generated a "Maximum Payout" value. This value represents the potential amount that can be obtained through a reverse mortgage based on the provided information.

Additionally, the website also displayed the corresponding Percentage of the Home Value, offering users a clear understanding of how much of their home's value can be accessed.

Was the Calculator Accurate?

While utilizing the website's information accuracy, discrepancies in the provided figures became apparent. When inputting a property value of $1,500,000 and a borrower age of 55, the website suggested a relatively low eligibility of $60,000.

We compared this result with actual loan amounts that reverse mortgage lenders would approve and found significant differences. Equitable Bank would lend from $195,000 to $225,000 based on rural or urban locations. Additionally, HEB's estimates for an urban location reached as high as $533,500. These differences are large and run the risk of being misleading to users.

Our Verdict

Here is our verdict on the Comparewise reverse mortgage calculator:

Pros:

- simple to use, no personal information required

Cons:

- Completely wrong information

- Clicking the “Get a Mortgage Quote” takes you into the regular online mortgage application process that is confusing and does not provide any reverse mortgage options for the user to select:

The Comparewise reverse mortgage calculator gets a lot of attention due to its overall website popularity (similar to Wowa) but by all accounts, it falls short. Comparewise does not provide a useful tool for anyone searching for a reverse mortgage and has a single generic article about reverse mortgages. The Comparewise reverse mortgage calculator is a terrible resource for anyone considering a reverse mortgage.

Our Grade

We give the Comparewsie reverse mortgage calculator an F grade.

Google Search Result #3: CHIP Reverse Mortgage Calculator

Who Are They?

The granddaddy of reverse mortgages in Canada, HomeEquity Bank (HEB) dominates the reverse mortgage market with its CHIP reverse mortgage and has spent years perfecting its presence online and with its infamous celebrity-endorsed commercials on television.

Is the Calculator Easy to Find?

The calculator's accessibility on the website was quite straightforward (or so I thought), thanks to the prominent and attention-grabbing yellow button located in the middle of the main page. It was hard to miss! The website designers certainly made it easy to access the calculator directly from the main page, ensuring users could quickly get started with their calculations.

However, as I began the process, I realized that I had inadvertently chosen the wrong path. Clicking the yellow button in the middle of the page led me to a contact form where I could request a quote from HEB. It was a helpful feature for those who preferred personalized assistance, but it wasn't what I was looking for at the moment.

To access the calculator itself, I had to navigate the website's drop-down menu located at the top of the page. Following the menu allowed me to find and utilize the calculator for my specific needs. While initially confusing, the drop-down menu provided an alternative route to access the calculator, ensuring users could still benefit from its functionality.

What Information Does the Calculator Require?

The information required to use the CHIP reverse mortgage calculator was comprehensive yet easy to provide: . The CHIP reverse mortgage calculator required five key pieces of information: age, gender, postal code, property type, and property value. These details were conveniently presented in drop-down fields, making it simple to select the appropriate options.

The CHIP reverse mortgage calculator respected user privacy by not requesting any personal information beyond the necessary details to generate accurate results. This ensured a smooth and efficient user experience, without the need to divulge sensitive data.

Additionally, the CHIP reverse mortgage calculator allowed for an optional second homeowner's details to be included, accommodating scenarios where multiple individuals co-owned the property. This level of flexibility ensured that users could customize the calculation based on their specific circumstances.

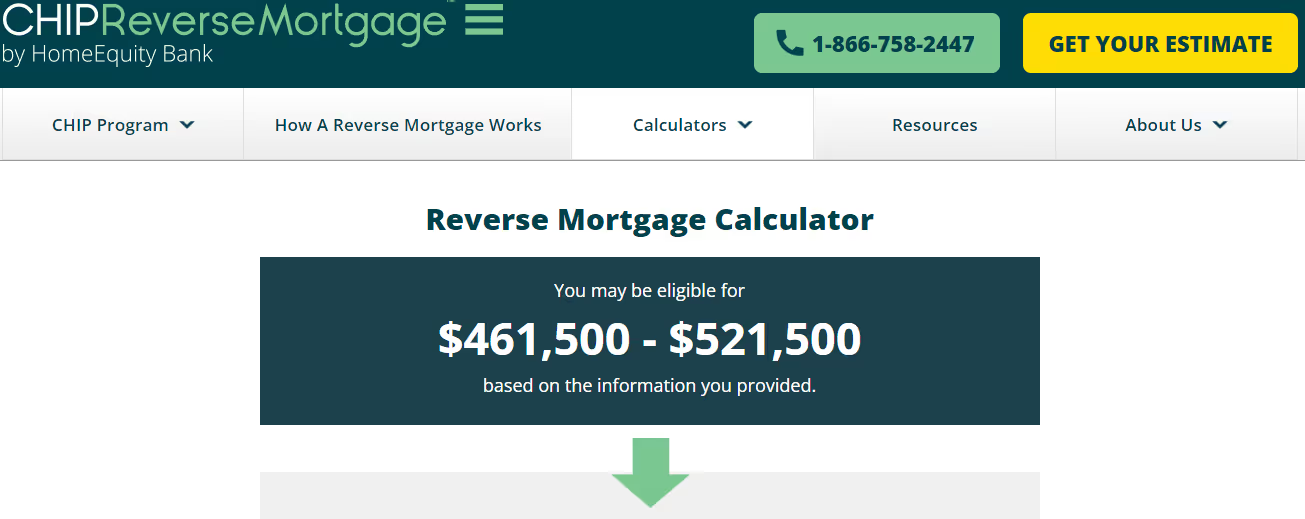

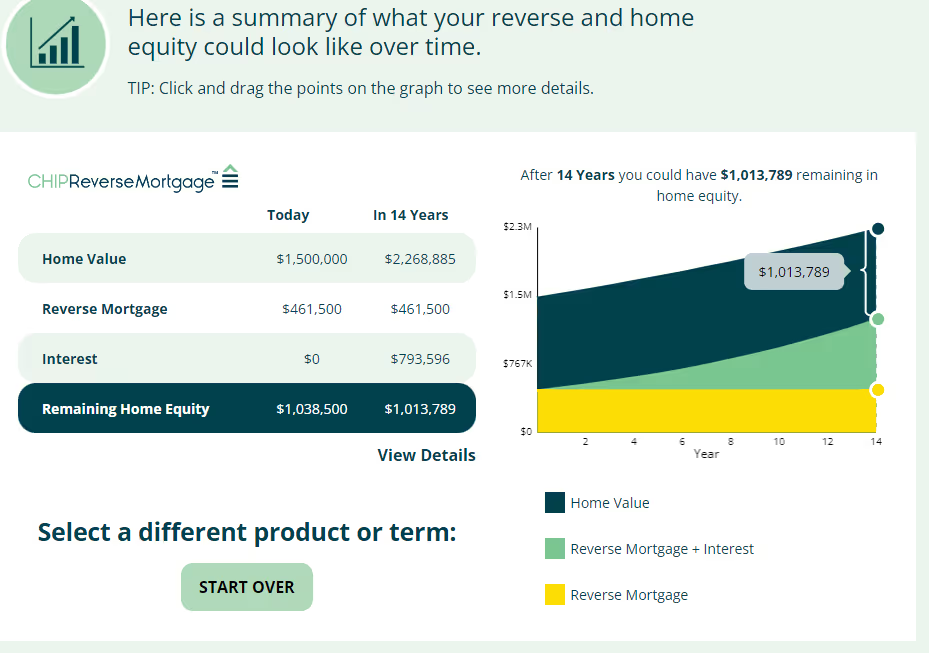

What Information Did the Calculator Provide?

The calculator provided valuable information in a straightforward manner, offering a loan amount range without requiring additional details from the user.

This allowed for a quick assessment of potential outcomes without the need for extensive input. One standout feature of the CHIP reverse mortgage calculator was the option to generate a custom report for the user.

This report offered detailed charts and calculations illustrating equity projections over a 20-year period. Users could customize the report by adjusting their expected property appreciation rate and selecting the desired length of projections, ranging from 1 year to 20 years. This level of customization allowed users to tailor the calculations to their specific needs and gain a deeper understanding of how their equity would evolve over time.

Here is what the customization report looks like:

In our view, the CHIP custom report was simple to follow, ensuring that users could easily interpret and analyze the provided information. The report could be conveniently downloaded by the user without the need to provide any contact information, offering a seamless experience and empowering users to access and review the report at their own convenience. No personal information was required in order to download the report.

While other platforms, such as Wowa, attempted to provide similar information, HEB excelled in delivering a smoother and more user-friendly experience. The clarity and accessibility of the custom report demonstrated HEB's commitment to providing valuable resources to its site visitors.

Was the Calculator Accurate?

When it comes to information accuracy, relying on the source itself ensures complete reliability. The information provided by CHIP reverse mortgage calculator is sourced directly from the company, guaranteeing 100% accuracy in terms of interest rates and possible loan amounts (subject to loan conditions being met, of course). By obtaining information directly from HEB, users can have full confidence in the accuracy of the details presented by the CHIP reverse mortgage calculator.

Our Verdict

Here is our verdict on the CHIP reverse mortgage calculator:

Pros:

- Works without requesting contact information.

- Easy to use and displays accurate information

- Gives lots of information and charts to review in a very easy-to-follow format that can also be downloaded in a PDF format which is great for future reference when discussing a reverse mortgage option with partners or other family members.

Cons:

- None, just accept the fact you are dealing with HEB and their CHIP reverse mortgage products only. Want additional information, you’ll need to DIY it from other websites.

Our Grade

We give the CHIP reverse mortgage calculator an A grade.

Google Search Result #4: Mortagecalculator.org Reverse Mortgage Calculator

Who Are They?

Mortagecalculator.org is a site that has…you guessed it, mortgage calculators! Unfortunately, although it provides a somewhat helpful reverse mortgage calculator, it’s based on American sources and completely unsuitable for Canadian homeowners.

It’s a shame that Mortgagecalculator.org does not clearly indicate its calculator is intended for a United States audience, and it’s even worse that Google is directing Canadian homeowners to an American site when our search was geo-specific to “reverse mortgages Canada”.

We skipped the rest of our analysis based on the complete irrelevancy to our search. Anyone looking for a reverse mortgage will be wasting their time and learning about American reverse mortgages rather than Canadian reverse mortgages—they are very different!

Our Grade

Based on its irrelevance to Canadian homeowners searching “reverse mortgage Canada”, we give the Mortgagecalculator.org reverse mortgage calculator an F grade.

A Better Option: RetireBetter.ca Reverse Mortgage Calculator

After being disappointed by Google’s results showing Mortgageorg.’s American-focussed reverse mortgage calculator, we decided to not rely completely on Google and find a better option for Canadian homeowners interested in getting information about reverse mortgages. So we went down the hall and talked to our colleagues at RetireBetter.

Who Are They?

Retirebetter is the largest mortgage broker team focussed on reverse mortgages in Canada. Everyone working at RetireBetter is a licensed mortgage agent who specializes in reverse mortgages. Unlike other reverse mortgage calculator sites highly ranked by Google, RetireBetter has a complete site dedicated to reverse mortgage resources designed for Canadian homeowners.

Is the Calculator Easy to Find?

Finding the RetireBetter reverse mortgage calculator was very easy. Right from the main page, site visitors can clearly see a button in the top-right corner that will take them to the RetireBetter reverse mortgage calculator:

The RetireBetter team understands the importance of providing a seamless and convenient user experience, and placing their reverse mortgage calculator in a prominent location on their home page demonstrates that.

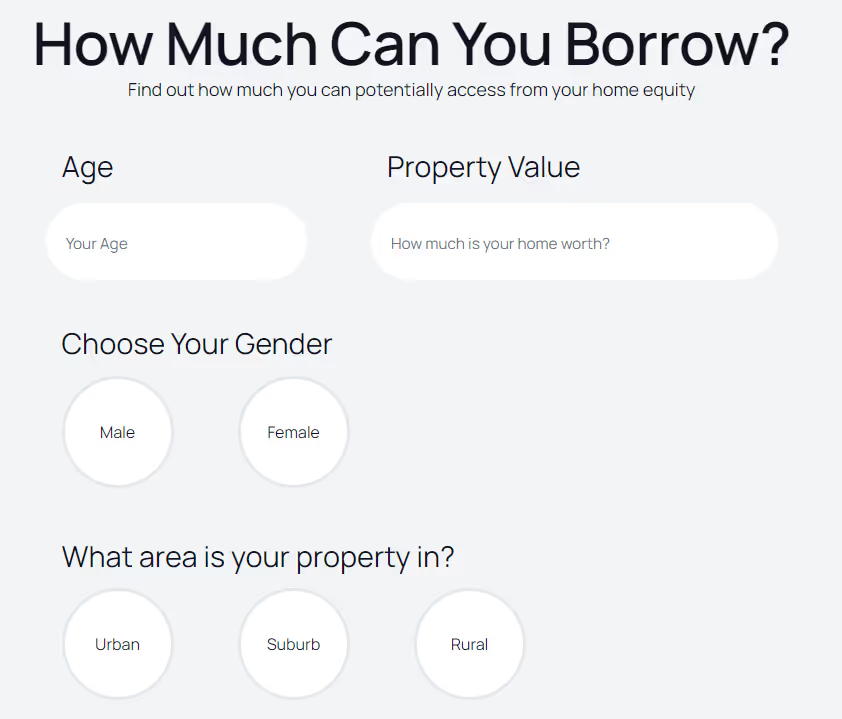

What Information Does the Calculator Require?

The information request process on the RetireBetter website for a reverse mortgage involves filling out a simple and user-friendly form. The form consists of four fields: age, gender, and property location. Many of these fields are presented as buttons rather than drop-down menus, making it easy for users to provide their information.

Here is what the RetireBetter reverse mortgage calculator screen looks like:

We liked that, in accordance with people’s preferences, you could use the RetireBetter reverse mortgage calculator without providing any contact information.

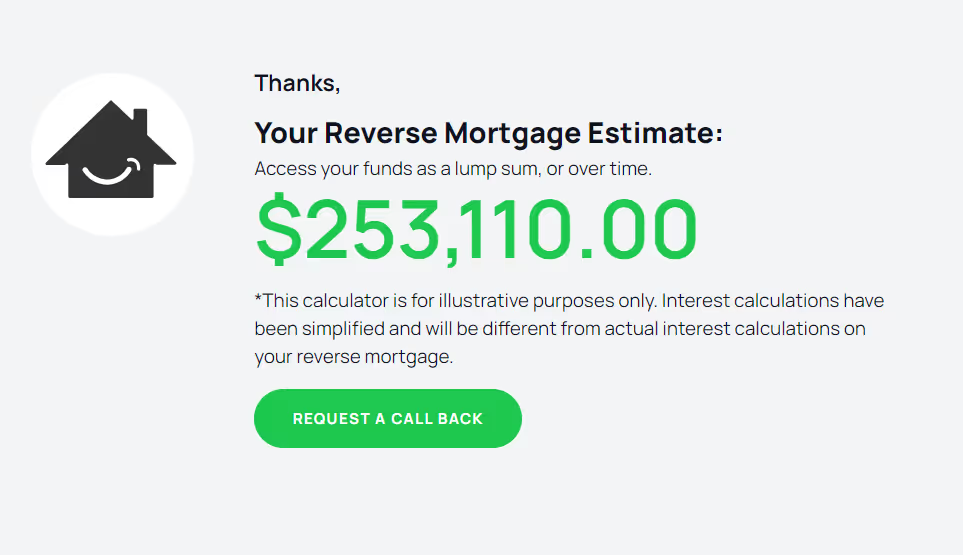

What Information Does the Calculator Provide?

The calculator provided valuable information in a straightforward manner, offering a loan amount range without requiring additional details from the user.

Was the Information Accurate?

The value provided by the RetireBetter reverse mortgage calculator clearly serves as an illustrative estimate, offering you a glimpse into the potential loan amount you may be eligible for. This calculator blends the information from major lenders and aims to provide you with a comprehensive view of the borrowing possibilities available to you. It’s a convenient approach for the first step anyone should take when they start investigating the suitability of a reverse mortgage.

Interestingly, on that last point of reverse mortgage suitability, RetireBetter was the only website we reviewed that offered a reverse mortgage suitability quiz for Canadian homeowners right on its homepage.

Visitors can answer a few basic questions without providing any personal information and see if a reverse mortgage would be suitable for their needs and priorities.

Our Verdict

Here is our verdict on the RetireBetter reverse mortgage calculator:

Pros:

- Easy to use and easy to follow information

- Takes information from major lenders and provides a hybrid loan approximation

- Gives access to additional information entirely focused on reverse mortgages in Canada

Cons:

- Provides blended information from major Canadian reverse mortgage lenders

This calculator does what it is supposed to do—provide an approximate loan amount for anyone starting to consider a reverse mortgage. RetireBetter understands that a reverse mortgage calculator is only the starting point of a journey. This calculator helps homeowners quickly understand their loan possibilities without going to multiple lender websites.

Our Grade

We give the RetireBetter reverse mortgage calculator a B+ grade.

Conclusion

Google can provide misleading information for Canadian homeowners searching “best reverse mortgage calculator Canada” so users should be sure they are on Canadian websites.

Google is also ranking general financial service websites like Wowa.ca and Comparwise.ca highly even though they do not provide accurate or detailed information specific to reverse mortgages.

In our view, the best reverse mortgage calculator in Canada is the CHIP reverse mortgage calculator and the RetireBetter reverse mortgage calculator is a strong option for homeowners to consider.