Are you considering a CHIP reverse mortgage in Canada? If you are, there’s one major pitfall you need to be aware of.

This is a common mistake and, in our experience, can cost homeowners thousands of dollars.

In some situations, this mistake even prevents homeowners over the age of 55 from getting a reverse loan.

And yet this mistake is easily avoidable.

Let’s talk about some basics first.

Understanding Reverse Mortgages

A reverse mortgage is a loan that allows homeowners aged 55 and older to access a portion of their home equity without selling their home.

The loan is repaid when the homeowner sells the home, moves out, or passes away.

The key points to understanding these reverse loans are as follows:

- No monthly payments are required and all owners must be 55 years or older

- The loan amount is based on your property value and age, not your income or credit score

Learn more:

Reverse Mortgage vs Home Equity Line of Credit

Now that we have the background information out of the way, let’s look at the one mistake homeowners need to avoid making when getting a reverse mortgage.

This mistake happens at the very beginning of the process when they start to get the reverse mortgage.

The Mistake People Make Getting a Reverse Mortgage

To be clear, we are not saying it’s a mistake to get a reverse mortgage.

We are saying the way most people get the loan is wrong.

Let’s explain what we mean…

Most people, when getting a reverse loan, simply reach out to HomeEquity Bank or Equitable Bank directly.

They don’t use the services of a reverse mortgage broker.

And that’s the biggest mistake a homeowner can make when getting a reverse mortgage.

Here are the potential consequences of not using a reverse mortgage broker:

Pay Higher Reverse Mortgage Interest Rates

Just like traditional mortgages, reverse mortgage lenders do not all charge the same interest rates on their loans.

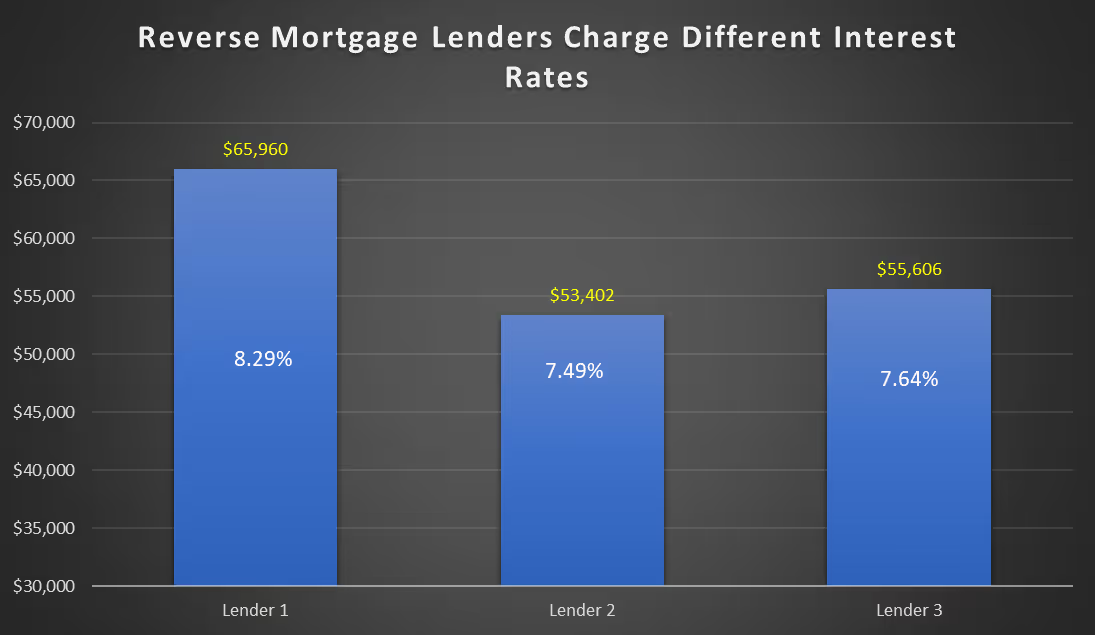

Here are how current interest rates vary between 3 different reverse loan lenders in Canada:

This chart shows how much interest builds up over 15 years for a $250,000 reverse mortgage.

If you chose the lender with the higher interest rate, you’ll pay an extra $12,558 in interest charges.

We know which lender is charging the highest interest rate, would you?

Bottom line, if you are getting this type of no payment mortgage yourself, you run the risk of unnecessarily paying a higher interest rate.

You would be surprised how many homeowners get this type of a loan without checking the interest rates offered by other lenders!

By using a reverse mortgage broker, you can ensure you are not overpaying for your reverse home loan.

Pay Higher Admin Fees

All reverse loans have a one time setup fee that is paid to the lender.

These charges are not the same and by working with a mortgage broker who has experience arranging reverse loans for seniors, you can be sure you are paying the lowest admin fee.

The difference in setup fees can sometimes be as much as $500…why should anyone pay this extra money? Our clients certainly don’t.

Miss Special Promotions

Did you know reverse mortgage brokers have access to unpublished promotions that are not made available to the public?

By getting a reverse mortgage yourself, you will not have access to these promotions which can range from interest rate specials, appraisal rebates, and even administrative fee discounts.

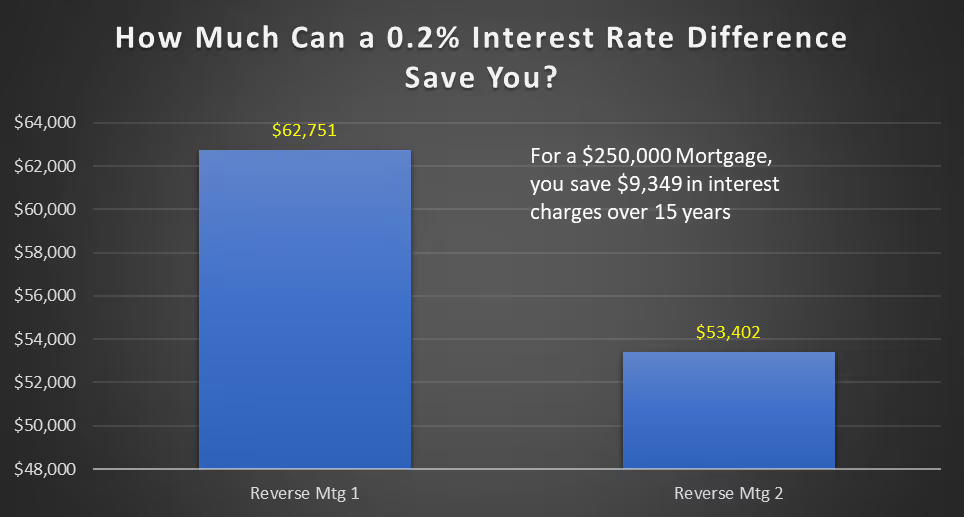

For example, at the time of writing this article, one of the lenders is offering a 0.20% discount to their broker partners that is not available for borrowers who are working directly with the bank.

That 0.2% may not sound like a lot but we ran the savings on a $250,000 using current reverse mortgage interest rates over 15 years.

Using a mortgage broker with access to an interest rate discount of 0.2% could save you $9,349 in interest charges over 15 years!

Decline Risk Increases

In our experience, if you are dealing directly with HomeEquity Bank or Equitable Bank and have any issues with your loan application, then you run the risk of getting your application declined.

These lenders like “cookie-cutter” deals and don’t generally look for exceptions to make a deal happen. In our experience, that’s just the culture of their internal sales teams.

In fact, we have taken over numerous reverse mortgage files over the years and gotten them approved even though they had initially been declined by the lender.

You could try, of course, to be your own advocate but it’s not likely you are going to succeed.

Instead, these lenders are much more willing to listen to a mortgage broker (such as RetireBetter) who has authority, expertise and experience in reverse mortgages.

Access to Higher Lending Limits

The general rule with reverse mortgages is that you can access up to 55% of the value of your primary residence.

In many cases, if you are between the ages of 55 and 75, then your lending limit will be much less than 55% of the value of your home—typically only up to 40% - 45%.

This lower lending limit means you will get a lower reverse mortgage approval. What if you need more money?

If you are dealing directly with the lender, then you are out of luck.

But if you are working with a reverse mortgage specialist such as RetireBetter, then you have access to higher loan limits for reverse mortgages—up to 65% of the value of your home.

We call this maximum reverse mortgage loan limit a “RetireBetter Bundle” which, as you may have guessed, is only available from RetireBetter.

Miss Out on Better Suited Products

A reverse mortgage is not ideal for everyone.

As experienced reverse mortgage experts, we fully understand this, so we make sure every client is a suitable candidate for a reverse mortgage.

In some cases, a traditional home equity line of credit or mortgage may be a better option for an older homeowner.

If you are dealing directly with a reverse mortgage lender, then they cannot help you arrange these other types of loans.

If you are advised to consider other loan options, you would have to start the application process all over again with other lenders.

However, if you are working with an experienced mortgage broker, they can easily change your application from a reverse mortgage to a HELOC or mortgage because they work with these other lenders as well.

How to Find the Best Reverse Mortgage Broker

If you are considering getting a reverse mortgage, not only should you work with a mortgage broker, but it's important to find one that specializes in reverse mortgages.

Since reverse mortgages are a small portion of the overall Canadian mortgage market, most mortgage brokers do NOT deal with them.

You should make sure you find a mortgage broker who specializes in reverse mortgages. They should have a deep understanding of the product, its benefits, and potential drawbacks.

Here are some tips to finding the best reverse mortgage broker:

- Assess their website:

Does the mortgage broker have a website that provides high-quality, and current information about reverse mortgages?

RetireBetter, for example, is a leading mortgage brokerage in Canada with a comprehensive, modern website that serves as a valuable resource for anyone interested in reverse mortgages.

Our website features educational materials, a reverse mortgage calculator, a reverse mortgage suitability quiz, a free downloadable e-book, and a range of useful articles that help homeowners make informed decisions about getting a reverse mortgage.

Unlike other mortgage broker websites that require personal information to use their website tools, RetireBetter allows visitors to use their calculators without providing personal contact information.

We believe homeowners should be able to try these tools without feeling the pressure of talking to a mortgage broker.

- Check online reviews:

Online reviews are a simple way to evaluate the quality of a reverse mortgage broker. Look for comments about other homeowners’ experiences; and look for a large number of consistent reviews.

Don’t just focus on basic Google reviews, look for your potential reverse mortgage broker on secure, transparent and reliable review platforms such as TrustPilot.

Trustpilot provides verified customer reviews, giving potential customers insight into the experiences of others, and is a trusted partner of Google.

RetireBetter is one of the highest rated mortgage brokers on TrustPilot and we’re proud of the consistently positive 5-star reviews our clients provide us.

- Ask family and friends for referrals:

Be careful when asking for referrals from friends and family!

Most people will refer you to their “regular” mortgage broker but remember—you are looking for a “reverse mortgage broker”.

Key Takeaways

- Reverse mortgages are gaining popularity in Canada, but they remain relatively unknown.

- Homeowners can obtain a reverse mortgage directly from lenders or through mortgage brokers.

- Mortgage brokers, like RetireBetter, offer a wider range of products, including reverse mortgages and traditional mortgages.

- RetireBetter has the only dedicated team of experts specializing in reverse mortgages.