I spent most of my working life paying down a mortgage and trying to become mortgage free—why would I want a reverse mortgage? In fact, why would anyone want a reverse mortgage? Especially if they are mortgage free?

This is a comment I hear quite a bit from clients. I’m sure you’re thinking the same thing as you read this article too.

In this article I’ll do my best to explain how a reverse mortgage works. At the same time though, I want to discuss how a reverse mortgage helps a homeowner.

In order to fully understand how a reverse mortgage works, I think a person has to also understand the problems it fixes for homeowners.

Because if you can understand the benefits of a reverse mortgage, then you have some context when you are looking at the costs of a reverse mortgage.

I think too many people are quick to focus on the costs of a reverse mortgage and make a judgment without understanding the benefits of a reverse mortgage.

I don’t want you to make the same mistake, so let’s start at the beginning and look at why people get reverse mortgages.

Why Do People Need Reverse Mortgages?

To answer that question, let’s look at some income data from Statistics Canada.

The average annual income for an adult aged 25-54 was $64,500 in 2021.

For adults aged 55 - 64, the average annual income dropped to $61,400 and dropped even further to $44,000 for adults over the age of 65.

Debt data from Statistics Canada is also relevant.

The average mortgage debt for adults under the age of 65 was $263,000 in 2019 and adults over the age of 65 still had average mortgage debt of $130,000.

In other words, a number of older Canadians are carrying a mortgage during their retirement years.

This data doesn’t include non-mortgage debt either, such as credit card debt, lines of credit, car loans, etc.

That’s an additional $28,200 (on average) for Canadians over the age of 65 and $38,500 for Canadians under the age of 65.

Of course, all this debt all comes with the need to make monthly payments.

Which might be manageable when you’re working. But how can you manage if you are retired?

Then you’re likely going to be facing a cash flow crunch.

And as Canadians look at that kind of cash flow crunch, sitting in their kitchen, they start to look around….at the biggest asset they own.

It’s an asset worth on average $741,000 in 2023 according to the Canadian Real Estate Association.

The one asset that has thousands of dollars of equity locked up in it.

How can a homeowner access that equity?

The traditional answer was to sell the home and downsize or even rent.

For seniors, the thought of selling their home is a difficult and emotional decision. It’s also a challenge to find affordable housing in today’s real estate market.

And it’s expensive to downsize with realtor commissions, moving costs, land transfer tax, etc.

Let’s go back to the original question: Why do people need a reverse mortgage?

The answer is simple: People need a reverse mortgage because it allows them to manage their debt in retirement and avoids the physical, financial and emotional costs of having to sell their home.

Learn more:

Reverse Mortgage Popularity Grows

The Costs of Downsizing for Seniors

Now that we’ve identified the reasons why people want (or need) a reverse mortgage, let’s get into what a reverse mortgage is.

What is a Reverse Mortgage?

A reverse mortgage is a home equity loan that allows Canadian homeowners aged 55 and older to access up to 55% - 59% of the equity in their homes.

The reverse mortgage is secured by the borrower’s primary residence and no monthly mortgage payments are required so long as the borrower lives in the home.

The borrower can keep the reverse mortgage for their entire life once they get it; the loan only needs to be repaid once the senior sells their home, stops living in it or passes away.

Since this is a loan, the money is received as tax-free cash by the homeowner and will not affect any Canadian pension (CPP and OAS) eligibility.

Normally, there are no restrictions or conditions on how a homeowner can use the funds they obtain from a reverse mortgage.

Overall then, we can say that a reverse mortgage is a loan that allows seniors over the age of 55 to convert the equity from their home into tax-cash without having to sell it.

Why Is It Called a Reverse Mortgage?

The “reverse” in reverse mortgage refers to the fact that interest is added back to the balance every month and the balance owing increases over time.

Let’s be clear here: a reverse mortgage is not free money.

A homeowner may not be required to make monthly payments but interest is still being calculated (just like any other mortgage).

This increasing loan balance is opposite to what we normally expect with a traditional mortgage where a borrower is making monthly payments and the amount owing decreases.

Reverse mortgages are also known as Home Equity Conversion Mortgages (HECM), Equity Release Mortgages or Later Life Mortgages.

In Canada, the CHIP Reverse Mortgage is synonymous with reverse mortgages but this is a brand name for the product offered by HomeEquity Bank. “CHIP” stands for “Canadian Home Income Plan”.

How is Reverse Mortgage Interest Calculated?

The interest on a reverse mortgage is calculated the same way it is calculated with a traditional mortgage.

In Canada, interest for both loans is calculated monthly and interest is compounded semi-annually.

A quick comparison to home equity lines of credit (HELOCs): the interest for a HELOC is compounded monthly (interest builds up faster the more frequent the compounding period).

Learn more:

Understanding Reverse Mortgage Interest Rates

Why Are Reverse Mortgage Rates So High?

We get this question all the time! People are under the impression that reverse mortgage interest rates are “criminal”.

Our answer is usually in two parts:

The first part is to ask if they were a lender, would they charge more than a normal loan if a borrower was not going to make monthly payments and not repay the loan for a number of years?

Not surprisingly, every person would expect to receive a higher interest rate if they were a lender in this scenario. It’s just a matter of perspective really.

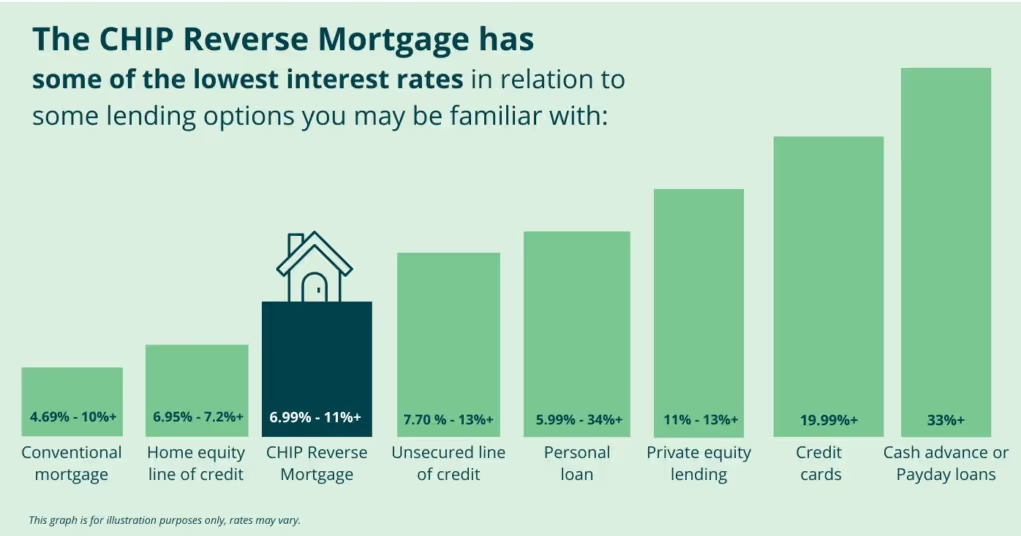

And the second part is to look more closely at reverse mortgage interest rates and compare them to other loans.

Here is how reverse mortgage interest rates traditionally compare to other loan options:

It’s true that reverse mortgage interest rates are higher than traditional mortgages and HELOCs but remember, these loan products require monthly repayments to be made.

And there are a number of loan products that seniors tend to take that are much more expensive than reverse mortgages.

Overall, we’d suggest that reverse mortgage interest rates are reasonable considering how these rates compare to other options as well as the overall benefits a senior can get from a reverse mortgage.

How to Qualify for a Reverse Mortgage

To qualify for a reverse mortgage in Canada, you must meet the following requirements:

- Be 55 Years of Age or Older

- Own Your Home

- Have Sufficient Equity

- Meet the Property Requirements

How Much Can You Borrow with a Reverse Mortgage?

The amount you can borrow with a reverse mortgage depends on several factors, including:

- Your Age

- Your Home's Value

- Your Home's Location

These factors are used to determine how much you will be able to borrow.

Anyone interested in knowing how much they could borrow with a reverse mortgage should try a free online reverse mortgage calculator.

Keep in mind that all online calculators are just approximate estimates.

In order to find an accurate reverse mortgage amount, homeowners need to complete a reverse mortgage application with a lender or their reverse mortgage broker.

Before the final reverse mortgage amount can be finalized, an appraisal will have to be completed on your home by a licensed home appraiser.

Which Lenders Offer Reverse Mortgages?

While there are a number of banks, credit unions and companies that offer mortgages, there are only 2 Canadian banks that offer reverse mortgages: HomeEquity Bank offers the CHIP Reverse Mortgage and Equitable Bank offers the Flex Reverse Mortgage.

CHIP Reverse Mortgage

HomeEquity Bank’s CHIP Reverse Mortgage is Canada’s most popular type of reverse mortgage.

The CHIP Reverse Mortgage is available for homeowners aged 55 or older and allows them to access up to 55% (in some cases 59%) of the equity in their homes.

The loan is only available for the retiree’s principal residence and cannot be taken out against second homes or investment properties.

Like all reverse mortgages, no monthly payments are required and the loan does not need to be repaid until the senior sells their home, stops living in it or passes away.

The CHIP Reverse Mortgage offers several options for receiving the funds, including a lump sum, regular payments, or a combination of both.

The loan's interest rate can be fixed or variable and mortgage terms range from 6 months to 5 years.

Learn more:

CHIP Reverse Mortgage Interest Rates

Equitable Bank Flex Reverse Mortgage

Equitable Bank’s Flex Reverse Mortgage is a relatively new type of reverse mortgage in Canada.

It allows Canadian homeowners aged 55 and older to access up to 59% of the equity in their homes.

Like other products, the EQ Flex Mortgage does not require monthly mortgage payments and does not need to be repaid until the homeowner sells the home, stops living in it or passes away.

The EQ Reverse Mortgage offers several options for receiving the funds, including a lump sum, regular payments, or a combination of both.

The interest rate on the loan can be fixed or variable and mortgage terms range from 1 year to 5 years.

Learn more:

EQ Reverse Mortgage Interest Rates.

CHIP & EQ Reverse Mortgage Differences

There are 2 essential differences between the CHIP Mortgage and the EQ Mortgage: lending location and pricing.

The CHIP Reverse Mortgage is more generous for suburban and rural locations in Canada. In fact, in our experience, we have never had an application declined because the location was not eligible.

The EQ Reverse Mortgage, on the other hand, is not offered in all parts of Canada, especially some rural locations.

In terms of pricing, since its introduction, the interest rate on the EQ Reverse Mortgage has been slightly lower than that on the CHIP Reverse Mortgage, and its setup costs have been slightly lower as well.

Learn more:

EQ Reverse Mortgage vs CHIP Reverse Mortgage

What Are Reverse Mortgage Fees and Costs?

Most seniors are concerned with the fees and costs of a reverse mortgage.

Here are the fees and costs associated with getting a reverse mortgage in Canada:

- A homeowner will need to pay a one-time set up fee to the lender that currently ranges from $995 to $1995

- A homeowner will need to pay for a property appraisal, which typically ranges from $300 to $500

- A homeowner will need to pay for independent legal advice, which will typically range from $300 to $750.

Other than the appraisal, all of these costs can be deducted from the loan proceeds and do not need to be paid up front by the homeowner.

As you can see, most of these costs are normal fees and charges. There are no unique fees and costs in getting a reverse mortgage.

Learn more:

If you are working with a trusted partner of your reverse mortgage lender, they may be able to offer you discounts on some of these charges.

How Do People Use Reverse Mortgages?

Aside from the requirement to pay off any existing mortgages or liens on your home, a reverse mortgage lender will not ask how you plan to spend the money.

Here are some common ways we see our clients use a reverse mortgage:

Boost Retirement Income

Canadian seniors with limited savings or a fixed income of CPP and OAS can get the financial boost they need through reverse mortgages.

When clients tell us they are facing monthly cash crunches, we set up their reverse mortgage so that they receive monthly installments of at least $1000 into their bank account.

The amount of the monthly installments can vary depending on the homeowner’s need and the size of the reverse mortgage.

By setting the funds to be provided over time instead of as a lump sum, we also reduce the interest charges since interest is only charges on funds once they have been used by the borrower (this is similar to a HELOC).

Paying off Debt

A reverse mortgage can pay off high-interest debt, such as credit card balances or loans.

These high-interest debts come with large monthly payments that can drain a retiree’s monthly cash flow.

By using a reverse mortgage to pay these high-interest debts, we not only improve the senior’s cash flow but we also lower their interest charges.

Funding Home Renovations

A reverse mortgage can be used to fund home renovations or repairs.

Aging in place has become very popular with older Canadians, especially after Covid.

With a reverse mortgage, seniors can renovate their home and make it suitable for their needs as they get older.

Learn more:

Use Like a HELOC

Homeowners love HELOCs and almost always ask for one when they contact us.

We understand this request because Canadians are familiar with HELOC and understand how to use them.

Unfortunately, Canadian seniors, due to their lower pension income, are finding it difficult to get approved for HELOCs.

As a result, reverse mortgages are becoming more popular ways to create a safety net, especially when structured as a line of credit themselves.

Both of the national lenders offer this option where a homeowner can access funds when needed and only pay interest on the amounts they actually borrow.

Helping Family Members

A reverse mortgage can help family members, such as providing a down payment for a child’s home or paying for a grandchild’s education or wedding.

We’ve seen clients give early inheritances to their family members with a reverse mortgage.

Our clients tell us they love being able to see the benefits their early inheritance gift was able to provide.

Delaying the Sale of a Home

Sometimes, it makes sense to sell your home but the timing is not right, either because the new home isn’t ready, poor market conditions or the time of year.

When our clients face this type of citation, we recommend a short-term reverse mortgage that will give them the money they need for renovations, deposits, moving costs, etc.

The short-term reverse mortgage can be paid off when the client’s home is sold.

This use of a reverse mortgage gives homeowners peace of mind and greater flexibility with their finances.

Let’s wrap up by answering some common questions about reverse mortgages.

Reverse Mortgage FAQs

What Happens if the Loan Balance Exceeds the Home’s Value?

While this is highly unlikely, both HomeEquity and Equitable Bank include a “negative equity guarantee” with their loans.

This means you and your heirs will not be responsible if the amount owing is more than the value of your home.

How Do I Pay Back a Reverse Mortgage?

A reverse mortgage must be paid back when you sell the home, stop living in it or pass away.

In any of these events, you (or your estate) would request a payout statement from the lender and make the payment just like any other mortgage.

Can I Make Monthly Payment on a Reverse Mortgage?

Both HomeEquity Bank and EQ Bank allow you to make monthly payments on your reverse mortgage if you wish, so long as the amount is not greater than the monthly interest amount.

Can I Outlive My Reverse Mortgage?

It is not possible to outlive your reverse mortgage in Canada. Whenever your existing mortgage term expires, you would renew for another term.

As long as you satisfy your reverse mortgage obligations, a lender will continue to renew your reverse mortgage.

What are Alternatives to a Reverse Mortgage?

Instead of getting a reverse mortgage, here are some options you could consider:

- Sell your home and downsize

- Sell your home and rent

- Get a tenant

- Get a traditional home equity loan or HELOC

- Use your savings or investments

If you are working with an experienced reverse mortgage broker, they should discuss all of these options with you as part of the reverse mortgage application process.

Can I Get a Reverse Mortgage with Bad Credit?

Reverse mortgage lenders do not require minimum credit scores to get approved for a reverse mortgage.

Your credit history is not important to a lender since monthly repayments are not expected with a reverse mortgage.

Learn more:

Can You Get a Reverse Mortgage with Bad Credit?

Are the Reverse Mortgage Horror Stories True?

Most of the horror stories you’ve heard about involve American reverse mortgages which are very different than Canadian reverse mortgages.

We’ve debunked these horror stories before and Canadian reverse mortgage lenders have very positive client reviews.

Conclusion

Reverse mortgages are becoming increasingly popular options for older homeowners for a reason: they offer benefits and features that Canadians want in their retirement years.

For older homeowners over the age of 55, these benefits and features outweigh the reasonable costs of reverse mortgages.

And if the end result is a stress-free retirement without financial pressures, we think reverse mortgages deserve serious consideration for every homeowner in the later years.