RetireBetter arranged more CHIP Reverse Mortgages last year than any other advisor in Canada - here is our review of the reverse mortgage option.

If you're a homeowner over the age of 55 in Canada looking for financial flexibility in retirement, a reverse mortgage may be a viable option.

In this article, we'll review the most popular reverse mortgage option in Canada, the CHIP Reverse Mortgage which is offered by HomeEquity Bank.

Key Takeaways

- CHIP Reverse Mortgages are popular loans for 55+ homeowners because they do not require monthly payments and allow homeowners to continue living in their homes

- CHIP Reverse Mortgages are available across Canada and the loan amount is based on your property value, your home’s location and your age

- CHIP Reverse Mortgage interest rates are reasonable considering no monthly payments are collected and the lender does not consider the homeowner’s income or credit

- CHIP Reverse Mortgages calculate prepayment penalties differently than traditional mortgages

What is a CHIP Reverse Mortgage?

A CHIP reverse mortgage is a loan product that allows homeowners over the age of 55 to access their home equity without having to sell their property or make monthly mortgage payments.

With a CHIP reverse mortgage, the interest is added to the loan balance instead of being paid off every month. The loan does not become due until you sell the home, move out or pass away.

By relieving retired homeowners of the pressures of making monthly payments, the CHIP Reverse Mortgage should be viewed as a lifestyle product designed to help seniors improve the quality of their retirement years.

Since the CHIP Reverse Mortgage is still a loan that eventually needs to be repaid, all the money a retired homeowner receives is received tax-free.

A CHIP Reverse Mortgage does not affect a senior’s government benefits such as the Guaranteed Income Supplement (GIS), Old Age Security (OAS) or Canada Pension Plan (CPP).

You are required to obtain independent legal advice before you receive funds so you can be sure you understand how a reverse mortgage works.

Learn More: How Does a Reverse Mortgage Work in Canada?

Who Can Get a CHIP Reverse Mortgage?

Any homeowner who is 55 years or older is eligible to receive a CHIP Reverse Mortgage. You cannot be too old to get a CHIP Reverse Mortgage—the older you are, the more you will be eligible to borrow.

Learn More: What are the Age Rules for Reverse Mortgages?

What are Mortgage Options for Seniors?

What Terms are Available with a CHIP Reverse Mortgage?

HomeEquity Bank offers homeowners 1, 3 and 5 year terms for the CHIP Reverse Mortgage.

For short-term cases, seniors also have the option of getting a CHIP Reverse Mortgage for 6 months.

At the end of any term, the homeowner has the choice to renew for another mortgage term.

This renewal process is typically automatic and the senior does not have to requalify in any way, other than completing a simple form indicating the new term requested.

How Much Can You Borrow from a CHIP Reverse Mortgage?

Your CHIP Reverse Mortgage loan amount will be based on a percentage of your home’s value and will also consider its location, along with the ages of all homeowners.

If your home is in a Canadian city or suburb, you will be approved for a larger amount than if your home is a rural or more remote area.

Generally, your maximum CHIP Reverse Mortgage loan amount will be 59% of the value of your home.

Did You Know: If you are working with a preferred reverse mortgage broker (such as RetireBetter), HomeEquity Bank may allow a homeowner to borrow up to 65% of the value of their home.

The smallest CHIP Reverse Mortgage you can get is $25,000. There is no limit on how large the CHIP Reverse Mortgage can be, subject to the above guidelines.

What Happens At the End of a CHIP Reverse Mortgage?

If the term of the CHIP Reverse Mortgage has expired, then the homewner simply needs to renew for a new term of 1-5 years at current interest rates.

If you sell the home, no longer live in the home or the last borrower has passed away, then the CHIP Reverse Mortgage must be paid back (principal plus accured interest).

What are CHIP Reverse Mortgage Interest Rates?

A senior can get a CHIP Reverse Mortgage with either a fixed or variable interest rate for any term offered by HomeEquity Bank. CHIP Reverse Mortgage interest rates are typically higher than traditional mortgages or home equity lines of credit because they do not require monthly payments to be made.

While reverse mortgages are often considered to be very expensive loans, their interest rates are significantly cheaper than credit cards, personal loans or private mortgages.

You can find the current posted CHIP Reverse Mortgage interest rates on the HomeEquity Bank website.

Did You Know: You can get a CHIP Reverse Mortgage at a lower interest rate by working with a reverse mortgage broker (such as RetireBetter).

What Kinds of Properties are Eligible for a CHIP Reverse Mortgage?

Generally speaking, all single family homes and condominiums are eligible for a CHIP Reverse Mortgage if they are worth more than $250,000.

Large acre properties are eligible so long as they are not generating farming income.

Homes on leased land are NOT eligible for a CHIP Reverse Mortgage.

Modular homes and pre-fabricated homes MAY be eligible for a CHIP Reverse Mortgage if they are worth more than $250,000 and are permanently fixed to the land.

Co-ops are also not eligible for a CHIP Reverse Mortgage.

What are CHIP Reverse Mortgage Setup Fees?

HomeEquity Bank charges a one-time setup fee of $1,795 for the CHIP Reverse Mortgages with a term of 1-5 years. The one-time setup fee is $2,995 for a 6-month CHIP Reverse Mortgage.

Seniors will also need to pay for their independent legal advice and appraisal expenses when arranging their CHIP Reverse Mortgages.

HomeEquity Bank allows the setup fee and the independent legal fees to be deducted from the mortgage proceeds so only the appraisal cost is paid out of pocket.

Appraisal costs typically range from $300-$600 dollars.

Where Does CHIP Reverse Mortgage Lend?

The CHIP Reverse Mortgage is available across Canada in all provinces. You can get a CHIP Reverse Mortgage regardless of whether your home is in an urban or rural location although your loan amount will be reduced in areas HomeEquity Bank considers to be less marketable.

What are CHIP Reverse Mortgage Property Requirements?

In order to qualify for a CHIP Reverse Mortgage, your home must be worth at least $250,000. You cannot get a CHIP Reverse Mortgage if your home is on leased land or a mobile home.

Also, the property must be your primary residence as second homes or rental properties are not eligible for a CHIP Reverse Mortgage. You must live in the home for at least 6 months in a year in order for it to be considered your primary residence.

Is a CHIP Reverse Mortgage Safe?

HomeEquity Bank guarantees that even though the loan balance increases over time, you will never owe more than the fair market value of your home, as long as you meet your contractual obligations.

This protection is known as the “negative equity” guarantee and is designed to make sure the homeowner (or their estate) is not going to be in financial difficulty when it is time to pay off the CHIP Reverse Mortgage.

According to our discussions with HomeEquity Bank, most retired seniors have the same amount of equity—or more equity—than when they initially got their CHIP Reverse Mortgage.

We looked at customer satisfaction ratings of HomeEquity Bank to see how homeowners felt after getting a reverse mortgage: the reviews were extremely positive and were better than most of the major Canadian Banks.

Taken together, homeowners should feel safe when considering a reverse mortgage.

Learn More: Are Reverse Mortgages Safe in Canada?

How Can You Receive CHIP Reverse Mortgage Funds?

HomeEquity Bank allows you to receive from a CHIP Reverse Mortgage in several ways:

- A single lump sum

- Scheduled regular payments (monthly, quarterly, etc.)

- Unscheduled payments as required by the homeowner

- Any combination of the above.

Interest is only charged on the funds when you receive it, so it’s possible to set up a CHIP Reverse Mortgage just like a traditional home equity line of credit.

Can You Get a CHIP Reverse Mortgage Using a Power of Attorney?

Since reverse mortgages are designed for retired homeowners aged 55 years or older, physical and mental capacity issues with older homeowners are quite common.

As a result, so long as you have a valid Power of Attorney in place at the time of the transaction, HomeEquity Bank will allow you to get a CHIP Reverse Mortgage if one of the homeowners is signing on behalf of another homeowner using a Power of Attorney.

HomeEquity Bank will require a copy of the Power of Attorney before completing the transaction and will ensure there is no abuse of the Power of Attorney.

If you are going to need to use a Power of Attorney to get a CHIP Reverse Mortgage, you should work with a reverse mortgage broker who is familiar with the process and can guide you through the steps to avoid any unnecessary concerns or delays.

Can You Make Payments on a CHIP Reverse Mortgage?

With a CHIP Reverse Mortgage, a senior homeowner can pay back up to 10% of the loan amount every year without having to pay any prepayment penalties. This is an excellent way for retired homeowners to reduce the long-term interest costs of a CHIP Reverse Mortgage.

Also, HomeEquity Bank allows a homeowner to make a single payment every month for the outstanding interest amount without penalty.

Homeowners who make these payments not only minimize their long-term interest costs of a reverse mortgage but are also able to make their CHIP Reverse Mortgage act like a home equity line of credit.

What are CHIP Reverse Mortgage Prepayment Charges?

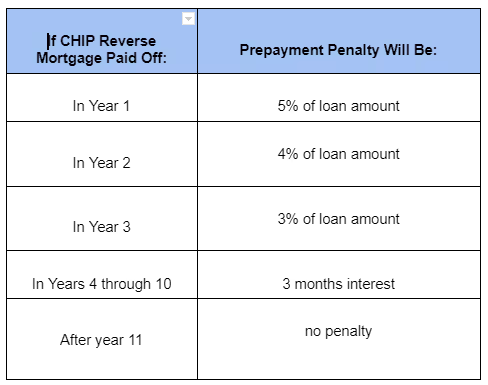

Just like most traditional mortgage loans, HomeEquity Bank will charge a homeowner a prepayment penalty when the CHIP Reverse Mortgage is paid within the first 5 years.

Did You Know: CHIP Reverse Mortgage prepayment charges are based on the initial date of loan setup rather than mortgage term. A homeowner may pay a prepayment penalty even when their reverse mortgage “term” has come due.

Here is a summary of the CHIP Reverse Mortgage Prepayment Charges:

Here are some other key points to keep in mind when looking at CHIP Reverse Mortgage prepayment charges:

- If the prepayment is made after 5 years and 30 days of your term renewal (your interest reset date), HomeEquity Bank will waive the prepayment charge

- HomeEquity Bank will take your 10% annual prepayment privilege into account when determining your prepayment penalty.

- The prepayment penalty will be waived when the last homeowner dies

- The prepayment penalty will be reduced by 50% if the last homeowner moves into a long-term care facility.

You should speak to a reverse mortgage broker near you if you have questions about how CHIP Reverse Mortgage prepayment penalties are calculated. An experienced reverse mortgage broker can help you set up your CHIP Reverse Mortgage to minimize (and sometimes avoid) prepayment penalties.

What Are My Responsibilities with a CHIP Reverse Mortgage?

If you get a reverse mortgage from CHIP, you have very simple obligations. You are required to pay your property taxes every year, keep the home insured and maintain the home’s condition.

Are There CHIP Reverse Mortgage Alternatives?

There are only 2 banks that offer reverse mortgages in Canada: HomeEquity Bank and Equitable Bank. These two lenders account for almost the entire reverse mortgage market in Canada.

Learn More: CHIP Mortgage vs Flex Reverse Mortgage

In recent years, Bloom Financial began to offer reverse mortgages also but it is not offered across Canada.

If you work with an experienced reverse mortgage broker near you, they should also have access to several other regional lenders that offer products very similar to the CHIP Reverse Mortgage.

Where Can I Get a CHIP Reverse Mortgage?

You can get a CHIP Reverse Mortgage by contacting HomeEquity Bank directly.

If you ask your existing bank about a CHIP Reverse Mortgage, they may refer you to HomeEquity Bank since they likely have a referral relationship in place.

Your current bank does not offer reverse mortgages. You can speak to any financial planners and they will likely refer you to HEB.

You can work with a mortgage broker but you should ensure they are experienced reverse mortgage specialists.

Out of all of these options, we recommend you deal with an experienced reverse mortgage broker who can save you time and stress of understanding the mortgage process.

They will be able to give you a one-stop shopping experience and make sure the CHIP Reverse Mortgage is the right solution for your needs.

FAQ

Q: Can I still leave an inheritance for my heirs if I get a CHIP Reverse Mortgage?

A: Yes, it is still possible to leave an inheritance of home equity for your heirs. However, the amount of the home equity inheritance will depend on the outstanding loan balance at the time of your passing.

Q: Can I use the funds from a CHIP Reverse Mortgage for any purpose?

A: Yes, there are no restrictions on how the reverse mortgage proceeds can be used. Borrowers may use the funds for any purpose, such as home renovations, healthcare expenses, travel, or to supplement their retirement income.

If you are buying a home with a reverse mortgage, you can even use the funds to pay for real estate land transfer taxes (but you must have a down payment of at least 45% of the real estate purchase price).

See how much you qualify for by using the RetireBetter reverse mortgage calculator.

Q: Do I need to have good credit to qualify for a CHIP Reverse Mortgage?

A: No, there is no credit score requirement to qualify for a reverse mortgage. Lenders will consider the equity in your home, your age, and your property's location.

You will not need to pay off any other debt, other than a regular mortgage you may have already in place. Even homeowners with bad credit can obtain a reverse mortgage!

Q: What does “CHIP” stand for? Does HomeEquity Bank offer other products?

A: The “CHIP” in CHIP Reverse Mortgage stands for “Canadian Home Income Plan”. HomeEquity Bank offers only reverse mortgage products. They are known as the CHIP Reverse Mortgage, CHIP Open and CHIP Income Advantage. HomeEquity Bank is the largest reverse mortgage lender in Canada.