Key Takeaways

- Reverse mortgages in Canada are becoming increasingly popular with retired homeowners and that trend is no different in Ontario or Toronto.

- A reverse mortgage can be a useful tool for homeowners in Ontario looking to tap into their home equity. HomeEquity Bank and Equitable Bank are the major lenders in Ontario.

- It's important to understand how a reverse mortgage works, its costs, and its potential impact on your home equity over time.

- While you can work directly with a lender, we recommend you work with an experienced, licensed mortgage professional who is certified in reverse mortgages.

Introduction

A reverse mortgage is a financial tool that allows Canadian homeowners over the age of 55 to tap into the equity of their homes without having to sell them.

This type of loan, sometimes called an "equity release," is becoming increasingly popular among older homeowners in Ontario, especially Toronto and the surrounding Greater Toronto Area (GTA), who are looking to supplement their income during retirement.

In this article, we’ll take a look at how Ontario homeowners over the age of 55 can decide if a no-payment home equity loan like a reverse mortgage is right for them.

Learn more:

Reverse Mortgage Popularity Continues

How Do Reverse Mortgages Work in Ontario?

In Ontario, as homeowners get older, they depend more on their pension income to make ends meet.

Unfortunately, with the constant rising costs of living in Ontario, older homeowners dependent on their pensions are finding it more difficult to live comfortably in their homes.

Reverse mortgages were designed exactly for this reason: to help older homeowners manage their financial affairs in retirement.

How does this type of home equity loan help retired Ontario homeowners?

The answer is simple: it allows retired homeowners to convert their home equity into cash without having to sell their home (which is normally the only way this equity could have been accessed).

Once seniors can access this equity, they can use the money to improve their retirement lifestyle and their monthly cash flow.

Unlike traditional mortgages or home equity lines of credit, this type of loan does not focus on the homeowner’s income or credit rating.

Reverse mortgage loans only look at how much the home is worth and the borrower’s age.

With reverse mortgage lenders only looking at these 2 main factors, this type of home equity loan is much easier for pensioners to qualify for.

What are the other key differences between a reverse mortgage and traditional loans?

There is no need for the borrower to make monthly mortgage payments.

And the loan does not need to be repaid until the borrower sells the home, moves out or passes away.

Overall, these qualities of reverse mortgages make the loan very attractive for seniors who are looking for a long-term solution to improve the quality of their retirement.

Learn more:

How Does a Reverse Mortgage Work in Canada?

Unlocking the Benefits of a Reverse Mortgage

Reverse Mortgage Lenders in Ontario

Only two Canadian banks offer reverse mortgages in Ontario, HomeEquity Bank and Equitable Bank.

The biggest lender in Ontario is HomeEquity Bank which offers the well known CHIP reverse mortgage.

This loan can be obtained directly from HomeEquity Bank or through mortgage brokers.

Based on industry statistics, the CHIP reverse mortgage in Ontario and the CHIP reverse mortgage in Toronto are the most popular no payment home equity loans taken by homeowners to access up to 55% of their home equity.

Equitable Bank also offers its reverse mortgage products in Ontario although it may not be available in more remote areas of the province.

There are also some smaller, regional lenders who provide reverse mortgages in Ontario who are only known by mortgage brokerages that specialize in reverse mortgages.

With these choices, it's important to research your reverse mortgage options before you select a lender.

You can make the process easier by working with an experienced reverse mortgage specialist who may be able to get you lower interest rates and higher loan amounts.

Learn more:

Which Lenders Offer Reverse Mortgages?

Reverse Mortgage Eligibility in Ontario

Let’s look at the eligibility rules if you are interested in getting a reverse mortgage from the 2 largest lenders in Canada, HomeEquity Bank and Equitable Bank.

As a side note, HomeEquity Bank provides the CHIP Reverse Mortgage and Equitable Bank provides the Flex Reverse Mortgage.

In order for Ontario homeowners to qualify for a reverse mortgage with one of these lenders, all homeowners need to be at least 55 years old.

And while these Banks do not need homeowners to be mortgage free, they do require homeowners to have a significant amount of equity in their homes, since they will not approve a reverse mortgage for more than 59% of the value of the home.

In other words, a homeowner needs to have at least 41% equity in their home in order to get approved for a CHIP mortgage or a Flex mortgage.

In our experience, we’ve found that sometimes homeowners can’t meet these 2 requirements: does this mean that a reverse mortgage is no longer an option?

Not quite.

Over the years, we have developed relationships with smaller, regional reverse mortgage lenders who will lend based on different rules.

These smaller lenders will be more flexible on the age requirement and can lend more than 59% of the value of the home.

In fact, many of our clients come to us in these circumstances after being declined for a CHIP Reverse Mortgage or a Flex Reverse Mortgage.

Learn more:

Why You Must Use a Mortgage Broker to Get a Reverse Mortgage

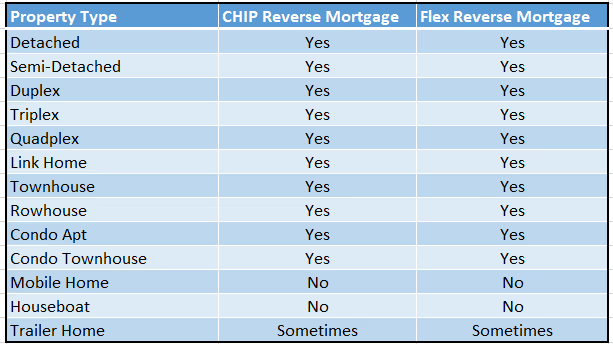

What Types of Homes are Eligible for Reverse Mortgages?

Lenders are quite flexible when it comes to lending on different types of homes in Ontario.

Here is a list of acceptable types of properties if you are looking for a reverse mortgage in Ontario:

Aside from looking at the type of home, both CHIP mortgages and Flex mortgages require the property value to be more than $250,000.

If your home’s value is less than $250,000, you may still be able to get a reverse mortgage from one of the other regional lenders we work with.

The home also needs to be your primary residence. You cannot get a CHIP mortgage or Flex mortgage for investment properties or second homes.

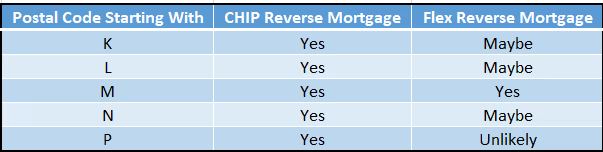

Does Your Location in Ontario Matter?

Like always in real estate, location matters.

Location matters because it affects property value, and property value affects your reverse mortgage approval amount.

So in which Ontario locations can you get a reverse mortgage?

The easiest way to answer this question would be to look at your postal code. Here is a list of postal codes that HomeEquity Bank and Equitable Bank will lend in:

From this chart, we can see that Equitable Bank does not offer its Flex Mortgage in every part of Ontario.

From our experience, Equitable Bank tends to offer its Flex Reverse Mortgage in urban and suburban locations.

The more rural your property, the less likely they will offer an approval.

HomeEquity Bank, on the other hand, offers its CHIP mortgage in every part of Ontario.

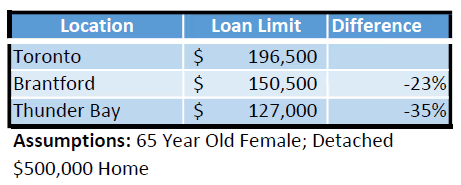

In our experience, however, just because your location is eligible does not mean you will be able to get the same sized loan as homeowners in other parts of Ontario.

In our discussions with Home Equity Bank, they’ve told us they grade the home’s location and marketability by classifying it in one of 3 categories: A to C.

As the home’s marketability grade drops from A to C, the Bank reduces its loan limit from its standard loan limits.

Here is an example of how location affects a possible CHIP Mortgage loan approval amount:

In this example, we are using a $500,000 property value for a detached home with a 65 year old female homeowner. The only factor we are changing is the home’s location.

We can see that Toronto has the highest loan approval of $196,500 and that as you enter less marketable markets, the loan amount can be reduced by almost 35%.

Options if You Need More Money

When we deal with clients all over Ontario (Canada, actually), we encounter the issue of clients needing more money than their initial CHIP or Flex mortgage allows for.

If you need more money, we can help in two ways.

The first way is to “bundle” the CHIP mortgage with another reverse mortgage, which we call a RetireBetter Bundle.

You cannot get a bundled CHIP loan if you deal with HomeEquity Bank directly—you must deal with a reverse mortgage broker such as RetireBetter.

With a RetireBetter Bundle, you can get a reverse mortgage solution for up to 65% of your home’s value.

The other option to get more money is to work with a different lender altogether.

RetireBetter has other reverse mortgage lenders that will often offer a larger reverse mortgage approval than CHIP.

If you want to work with these other reverse mortgage lenders, make sure you review the details carefully with your reverse mortgage broker, since there are differences between HomeEquity Bank and these other lenders that you should be aware of.

How to Get a Reverse Mortgage in Ontario

You can apply for a reverse mortgage by dealing directly with a reverse lender or by working with a mortgage broker.

If you work directly with a lender, you will have to apply to each lender separately, including providing copies of your identification and supporting documents..

This means you will have to complete an application with each bank and have multiple credit checks completed.

On the other hand, by working with a mortgage broker, you can make a single application and access multiple lenders.

Plus, the bonus is you will have only one credit check done so your credit score will not suffer.

If you work with a mortgage broker, make sure to select one that has experience with reverse mortgages so that they will be able to easily and properly explain how a reverse mortgage works in Ontario (or Canada for that matter).

Not all mortgage brokers are familiar with reverse mortgages!

During the application process for a reverse mortgage, your lender will take into account several factors such as the age of all homeowners, your home’s location, and a home appraisal.

A mortgage quote will then be provided to you, which if you accept, will result in a property appraisal being completed.

Once the appraisal is completed, final documents are prepared and you are sent for a meeting with a lawyer to get independent legal advice.

After your independent legal advice is completed, the lender (or your broker) will arrange for signing the final documents and registration of the reverse mortgage.

Once the mortgage is registered on title, the money is advanced and deposited into your bank account.

The process is not complicated but we often feel that way because we’ve done so many reverse mortgage transactions over the years.

If you are getting your own reverse mortgage, then the process can seem a bit confusing and somewhat stressful but it usually always works out fine.

If you think you might feel a bit overwhelmed with the process or are not happy dealing directly with a reverse mortgage bank, you always have the option of switching to a reverse mortgage broker, who can take over the process and make everything proceed smoothly.

How to Use a Reverse Mortgage in Ontario

Before you can do anything with your new loan, reverse mortgages for homeowners in Ontario require you to pay off any existing mortgages or home equity lines of credit.

The remainder of the reverse mortgage loan can be used for anything you wish.

We find the most popular ways our clients use a reverse mortgage is to pay for home repairs or improvements, covering regular bills, healthcare expenses, or repaying other debts.

An increasingly common use is to renovate the home so the homeowners can age in place.

These types of renovations can include installation of ramps, widening doorways for wheelchairs, installing safety bars in bathrooms or even bedrooms for future live-in caregivers.

Other common uses for reverse mortgage funds include assisting children and grandchildren with university tuition or home purchases.

The key takeaway is that a borrower can use the money from a reverse mortgage any way they want; they receive the funds as tax-free cash and have complete freedom to use the money.

Learn more:

Aging in Place with a Reverse Mortgage

Repayment of a Reverse Mortgage

While a reverse mortgage can provide financial relief, it's important to to understand that it is a loan that will eventually need to be repaid.

Depending on the circumstances, there may be prepayment charges involved with repaying a reverse mortgage.

The prepayment charges generally apply if you repay a reverse mortgage within the first 5 years of taking the loan.

The longer you wait to repay the mortgage, the lower the prepayment charge. Eventually, after 5 years, you can avoid the prepayment charge altogether by giving 3 months notice to the lender.

Learn more:

Reverse Mortgage Prepayment Charges

Cost of a Reverse Mortgage in Ontario

In spite of the benefits of reverse mortgages, there are some associated costs to consider.

These may include a higher interest rate compared to traditional mortgages and, as mentioned above, the possibility of a prepayment penalty if you choose to pay off your reverse mortgage.

Learn more:

Current Reverse Mortgage Interest Rates

The lender will typically have a one time fee for closing and administrative costs and borrowers will also need to pay their own legal fees for closing costs and independent legal advice.

HomeEquity Bank set up costs range from $1795 to $2495 and Equitable Bank set up costs are usually around $995.

As a preferred partner of HomeEquity Bank, we are often able to get reduced set up fees for the CHIP Reverse Mortgage.

To see if the costs of a reverse mortgage are worthwhile, it's useful to try one of the many free reverse mortgage calculators (Ontario) to estimate potential loan amounts.

These online calculators are easy to use and can explain how a reverse mortgage works in Ontario as well as how interest on a reverse mortgage in Ontario works.

Learn more:

Initial & Ongoing Reverse Mortgage Costs

Reverse Mortgage Pros and Cons in Ontario

Getting a reverse mortgage is an important event, and homeowners need to consider the advantages and disadvantages carefully.

The advantages of reverse mortgages are simple:

- You are not required to make mortgage payments for the life of the loan.

- You can access your equity without selling your cherished home.

- You receive the funds tax free and the loan will not affect your other government benefits such as old age security (OAS) or the guaranteed income supplement (GIS)

- You can receive the funds as a lump sum or spread out in installments.

However, the disadvantages to reverse mortgages in Ontario include:

- Reverse mortgage interest rates can be higher than regular mortgages.

- The potential decrease in your home's equity as you accumulate interest on your loan.

We have gone over these advantages and disadvantages many times with our clients and our message is always the same: seniors need to look at this loan as a “lifestyle” product.

Seniors should not focus on just the interest rates of a reverse mortgage.

Instead, they need to think of the financial independence and dignity this type of a home loan can provide them in their retirement.

We admit the benefits of a no payment home equity loan are difficult to put a value on, so it’s quite normal for older homeowners to be hesitant in getting a reverse mortgage.

But here’s a fact about these loans for seniors: in all the years we have been arranging these loans, we have never had a client regret the decision.

Our experience seems to be supported by overall customer satisfaction with HomeEquity Bank and the CHIP Reverse Mortgage which is far better than banking standards.

Bottom line: In our experience, the people who get a reverse mortgage do not regret it.

Learn more:

Pros & Cons of Reverse Mortgages

Reverse Mortgage Alternatives

Our high client satisfaction with reverse mortgages can probably be explained by our approach when discussing the topic with seniors.

Aside from explaining to them how a reverse mortgage works, its advantages and disadvantages, costs etc. we also compare this no payment loan option with traditional loan options such as mortgages and lines of credit.

We also discuss the option of downsizing with homeowners.

In the end, a client has all of the options in front of them and can make an informed decision they are comfortable with.

Not surprisingly, if they decide they want to get a reverse mortgage, it’s a decision they are comfortable with.

FAQs

- Can I get a reverse mortgage if I have bad credit?

You can get a reverse mortgage with bad credit since lenders do not look at your income or ability to make monthly mortgage payments.

Learn more:

Can You Get a Reverse Mortgage with Bad Credit?

- Can I make monthly payments on a reverse mortgage?

You have the option of making monthly payments on your reverse mortgage if you wish. Both CHIP and the Flex mortgage allow you to pay the interest amount every month.

- Can I owe more than my house is worth if I get a reverse mortgage?

If you get a CHIP Mortgage or a Flex Mortgage, both lenders guarantee you will never owe more than the value of your home.

Not all reverse mortgage lenders offer this protection so check with your advisor for more details.

Learn more: